Publicly traded Saas companies software as a Service (SaaS) has transformed the tech industry. Many SaaS companies are now publicly traded, offering new investment opportunities.

Publicly traded SaaS companies play a key role in the stock market. These firms provide software solutions via the cloud, making it easier for businesses to operate. They offer services like customer relationship management, data analytics, and project management. The success of these companies reflects the growing demand for digital solutions.

Investors often look at these companies for their growth potential and stability. Understanding these companies can help you make informed investment decisions. Let’s explore the world of publicly traded SaaS companies and see what makes them stand out in today’s market.

Introduction To Publicly Traded Saas Companies

Publicly traded SaaS companies have become major players in the tech industry. They offer software solutions that are essential for modern businesses. The term “SaaS” stands for Software as a Service. It is a method of software delivery that allows data to be accessed from any device with an internet connection.

What Is Saas?

SaaS, or Software as a Service, is a cloud-based service. It allows users to access software applications over the internet. The software is hosted on a remote server. The provider takes care of maintenance, updates, and security. Users typically pay a subscription fee to use the software.

SaaS applications are used in a variety of business functions. These include customer relationship management (CRM), human resources (HR), and accounting. The most well-known SaaS companies include Salesforce, Adobe, and Microsoft.

Importance Of Saas In Modern Business

SaaS has transformed how businesses operate. It offers several key benefits:

Cost Efficiency: No need to purchase expensive hardware or software licenses.

Scalability: Easily add or remove users based on business needs.

Accessibility: Access applications from anywhere with an internet connection.

Automatic Updates: Providers handle software updates and security patches.

These benefits make SaaS an attractive option for businesses of all sizes. It allows small businesses to access advanced software without a large upfront investment. Large corporations can streamline their operations and reduce IT costs.

Below is a table highlighting some of the top publicly traded SaaS companies and their market capitalizations:

Company Market Capitalization (in billions)

Salesforce $200

Adobe $300

Microsoft $2000

SaaS companies continue to grow rapidly. They offer innovative solutions that meet the evolving needs of modern businesses. As technology advances, the importance of SaaS will only increase.

Market Trends

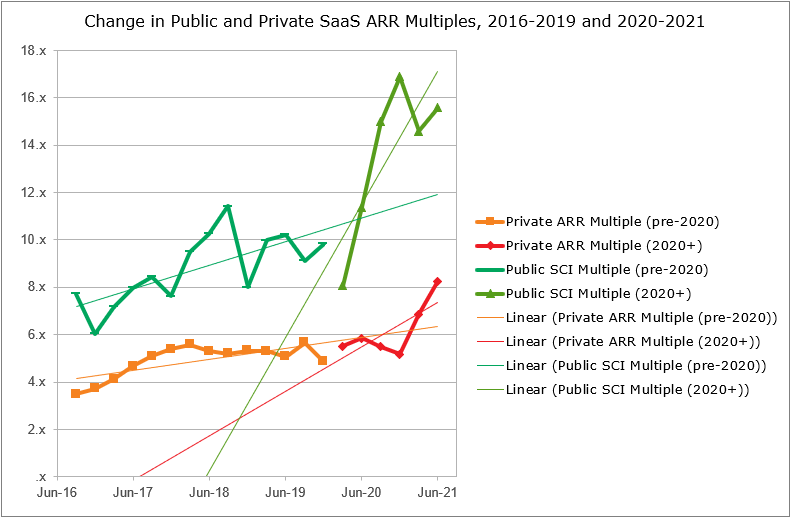

Publicly traded SaaS companies are always evolving. The market trends show promising growth and innovation. With new technologies emerging, the landscape is set to change.

Growth Projections

Experts predict significant growth for SaaS companies. The demand for cloud-based solutions will increase. Businesses are shifting towards subscription models. This trend is driving the growth.

According to market analysts, the SaaS industry could see a 15% annual growth. This growth is fueled by the need for flexible and scalable software solutions. Companies are investing more in SaaS to stay competitive.

Emerging Technologies

New technologies are shaping the SaaS industry. Here are some key areas to watch:

Artificial Intelligence (AI): SaaS platforms are integrating AI for better data analysis.

Machine Learning (ML): ML helps in automating processes and enhancing user experiences.

Blockchain: Enhances security and transparency in SaaS applications.

Internet of Things (IoT): SaaS solutions are increasingly supporting IoT devices.

These technologies are not just trends. They are transforming how SaaS companies operate. Businesses adopting these technologies will likely lead the market.

Top Performers In The Saas Industry

Top performers in the SaaS industry are companies that consistently demonstrate growth, innovation, and customer satisfaction. These companies have become leaders through their unique solutions and reliable services. They are often publicly traded, giving investors a chance to benefit from their success. Let’s dive into the criteria for selection and an overview of some leading companies.

Criteria For Selection

We evaluate companies based on several factors. Revenue growth is crucial. A company that steadily increases its revenue shows stability. Customer satisfaction is another key factor. High satisfaction rates indicate reliable services. Innovation also plays a significant role. Companies that innovate tend to stay ahead. Lastly, market presence is important. It shows how well a company is known and trusted.

Overview Of Leading Companies

Several companies stand out in the SaaS industry. Salesforce is a top performer. Known for its CRM solutions, Salesforce has a massive market presence. Its revenue growth is impressive. Adobe is another leader. Adobe’s creative and document solutions are industry standards. Their customer satisfaction rates are high. Microsoft also excels in the SaaS space. With its Office 365 suite, Microsoft continues to innovate and grow. These companies set the bar high for others in the industry.

Company Profiles

Publicly traded SaaS companies are shaping the future of technology. Understanding their strengths and weaknesses can help investors and users make informed decisions. This section will profile two prominent SaaS companies, highlighting their key attributes.

Company A: Strengths And Weaknesses

Company A has a strong market presence. It offers a diverse range of SaaS products. These products cater to various industries. The company boasts a high rate of customer satisfaction. Its user-friendly interfaces are a major plus. The robust security measures ensure data protection. However, Company A faces stiff competition. Its pricing can be a drawback. Some users find the cost prohibitive.

Company B: Strengths And Weaknesses

Company B is known for its innovative solutions. It continuously updates its software. This keeps it ahead of the curve. The company has a dedicated customer support team. This team is available 24/7. Users appreciate the prompt assistance. Another strength is its flexible pricing plans. These plans cater to small and large businesses. On the downside, Company B sometimes experiences technical glitches. These glitches can disrupt service. Some users report occasional downtime.

Financial Metrics To Watch

Understanding the financial health of publicly traded SaaS companies is crucial for investors. Financial metrics provide insights into a company’s performance. They help investors make informed decisions. Two key metrics to watch are revenue growth and profit margins. These metrics indicate a company’s ability to generate income and control expenses.

Revenue Growth

Revenue growth shows how fast a company’s income is increasing. It is a key indicator of a company’s market success. Higher revenue growth often means the company is gaining market share. It can also suggest strong demand for the company’s services. Investors should look for consistent and sustainable growth. A steady increase in revenue is a positive sign.

Profit Margins

Profit margins measure how much profit a company makes relative to its revenue. Higher margins indicate better cost control and efficiency. There are different types of profit margins, such as gross and net margins. Gross margin looks at revenue minus the cost of goods sold. Net margin considers all expenses, including taxes and interest. Consistent profit margins are a sign of financial health.

Innovative Products And Services

Publicly traded SaaS companies are at the forefront of innovation. They consistently introduce new products and services that captivate users and transform industries. These offerings not only enhance user experience but also drive significant market shifts.

New Offerings

These companies are known for their relentless pursuit of innovation. They launch products that address emerging needs and streamline operations. This approach helps them stay ahead in a competitive market.

For instance, many SaaS firms now offer AI-powered analytics tools. These tools provide actionable insights and improve decision-making processes. Another trend is the integration of machine learning for better customer personalization. This enhances user engagement and satisfaction.

Cloud-based solutions are also gaining popularity. They offer scalability and flexibility, meeting the needs of diverse businesses. Subscription models make these advanced tools accessible to small and medium enterprises as well. Also learn more……

Impact On Market

Innovative products and services from SaaS companies reshape the market landscape. They set new standards and push competitors to innovate. This dynamic creates a vibrant ecosystem, benefiting end-users and businesses alike.

Market leaders often see their stock prices rise with each successful product launch. Investor confidence grows with proven innovation and user adoption. Smaller companies also gain opportunities to carve niches with unique offerings.

Overall, these advancements drive industry growth. They foster a competitive environment that encourages continuous improvement. The impact is far-reaching, influencing market trends and user expectations.

Investment Opportunities

Publicly traded SaaS companies present diverse investment opportunities. These firms offer software as a service, providing steady revenue streams. Investors find this model appealing for its predictability and growth potential. Exploring the investment landscape of SaaS companies can reveal promising prospects.

Risk Factors

Investing in SaaS companies involves understanding various risk factors. Market volatility can impact stock prices significantly. Economic downturns may reduce demand for software services. Competition is fierce, with new entrants constantly emerging. Technological changes can also disrupt established players. Investors must be aware of these risks.

Long-term Potential

SaaS companies often exhibit strong long-term potential. These businesses benefit from recurring revenue models. Customer retention rates tend to be high, ensuring steady income. Innovation and adaptability are key strengths. Many SaaS firms continuously evolve their offerings. This adaptability helps them stay relevant and competitive.

Moreover, global digital transformation trends support SaaS growth. As businesses migrate to cloud solutions, SaaS adoption increases. This trend is expected to continue, driving future growth. Investors who recognize these patterns may find lucrative opportunities. Long-term potential in SaaS investments can be significant.

Frequently Asked Questions

What Are Publicly Traded Saas Companies?

Publicly traded SaaS companies are software-as-a-service businesses listed on stock exchanges. They offer subscription-based software solutions. Investors can buy and sell their shares.

Why Invest In Publicly Traded Saas Companies?

Investing in publicly traded SaaS companies can be lucrative. They often show high growth potential. Their recurring revenue model ensures steady income.

How To Find Top Saas Companies To Invest?

To find top SaaS companies, research market leaders. Look for strong financials and growth potential. Check industry reports and analyst recommendations.

What Are The Risks Of Investing In Saas Companies?

Investing in SaaS companies carries risks. Market volatility and competition can affect stock prices. Company-specific issues can also impact performance.

Conclusion

Publicly traded SaaS companies play a vital role in today’s market. They offer scalable solutions for businesses of all sizes. Investing in these companies can be a smart move. Their growth potential is significant. Keep an eye on market trends and financial reports.

This will help you make informed decisions. Choose companies with strong performance records. Stay updated and informed. This ensures you get the most from your investments. SaaS companies continue to innovate and expand. Their future looks promising.stments. SaaS companies continue to innovate and expand. Their future looks promising.